National Insurance Contributions see-saw

National insurance (NI) payments, which increased in April 2022 due to an increase in rates, went down again on 1 July 2022 when the repayment threshold increased. In this article, Mo Chaudhry outlines NI changes for the current tax year 2022/2023 – and their potential impact on your finances.

Who pays National Insurance Contributions?

National Insurance contributions (NICs) is a tax paid by:

• Employees and the self-employed on earnings; and

• Employers on the earnings of their employees

There are certain exceptions where NICs are not due, such as low-wage earners, pensioners, etc.

What are the changes taking place?

There are two changes taking place during this current tax year 2022/23:

1. From 6 April 2022, rates have been raised

2. From 1 July 2022, the NI threshold (the point at which people shall start to pay NICs) has increased

Increase in rates

Impact on employees and sole traders

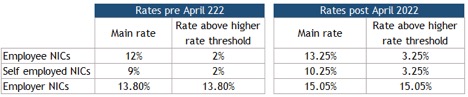

From April 2022, NI has increased by 1.25 per cent, which means for employees earning between £9,880 (£12,570 from July 2022) to £50,270, will pay NI at 13.25 per cent instead of the pre-rate of 12 per cent. Likewise, income generated over £50,270 will attract an NI of 3.25 per cent (previously two per cent). In simple terms, for every £100 earned over £9,880, you will now pay an extra 1.25 per cent to HMRC, reducing your take home pay.

Impact on locums trading under a limited company structure

The NI increase will have no effect on locums working under a limited company structure, where their salaries are normally fixed at the primary threshold upon which no NI is due. Does this mean locums who take a low salary, will not be impacted by this rise? In short, no. This is because dividend rates are also increasing.

Every year, people are also awarded a dividend allowance of £2,000. However, dividend income exceeding the allowance is subjected to tax payment. Luckily, the dividend allowance has not changed, however, the dividend tax charge will also observe an increase by 1.25 per cent as well.

From the 2022-23 tax year, basic rate dividend tax will be charged at 8.75 per cent instead of 7.5 per cent this year. Higher rate dividend taxpayers will be charged 33.75 per cent instead of 32.5 per cent – and additional rate dividend taxpayers will pay 39.35 per cent instead of 38.1 per cent respectively.

This increase could mean a revisit on how much salary one would want to extract from their company, since salary is a tax-deductible expense and dividends are not. Company profit after corporation tax can be distributed to company shareholders as dividend payments. However, recipients will be subjected to pay tax on the acquired dividends; hence, affecting the overall take home pay.

Impact on employers

Employer NI has increased from 13.8 per cent to 15.05 per cent. This is applicable on all staff who are paid above the primary threshold, £9,100 from April 2022. It is a double whammy for those locums assuming responsibilities as sole director of their companies and having a salary above the determined. The table below demonstrates this increase.

Increase in National Insurance threshold

In the 2021-22 tax year, the main rates of employee and self-employed NICs started to be paid on earnings (or profits) above £9,568. From 6 April, this threshold increased to £9,880 (thresholds tend to increase each April to account for inflation).

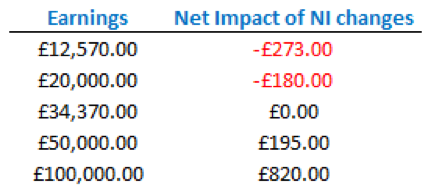

From 6 July 2022, the threshold increased to £12,570, which should help offset some of the increase in the NIC rates. The exact impact will vary according to how much you earn and how you are affected by other tax and benefit changes.

What does this mean?

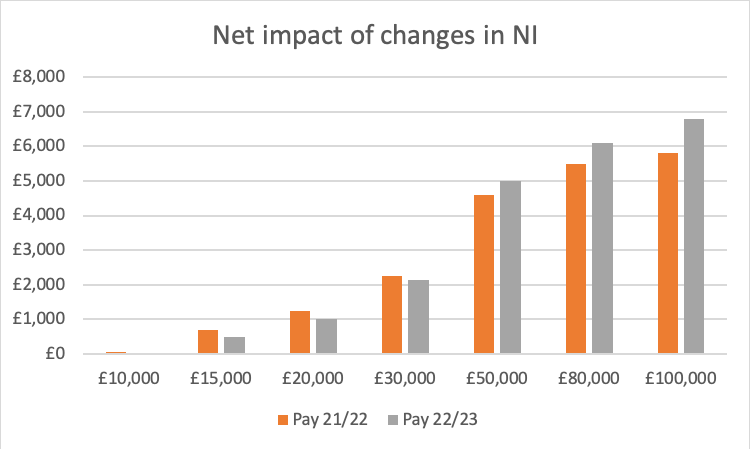

Those earning less than around £35,000 will see a fall in their overall NICs bill in 2022-23 relative to 2021-22. Those earning more than this will see an increase in their overall NICs bill.

The self-employed pay less in NICs than employees but will face the same annual changes (because they are subject to the same change in threshold and the same rate rise).

The effects on employees would be larger than shown here to the extent that an increase in employer NICs leads wages to be lower than they otherwise would be.

For more information on the impact of increase in NI and how it can impact your trading, contact Mo Chaudhry (dual qualified locum optometrist and chartered accountant) on mochaudhry@locumkit.com

Locumkit is an online locum management platform created for locums by locums. For more information and advice, visit its website.