The introduction and growth of optical coherence tomography (OCT) into mainstream independent practice has been one of the most significant events for the profession in the last decade. Due to the Covid-19 pandemic, it is now more important than ever to preserve your cash flow and differentiate your practice.

Not only does an OCT allow for more socially distant diagnosis, but funding your new OCT can offer a number of significant commercial benefits:

- Impressive additional profit stream

- Improved patient offering

- Attract new patients

- Increase your tax allowances

- Practice differentiator

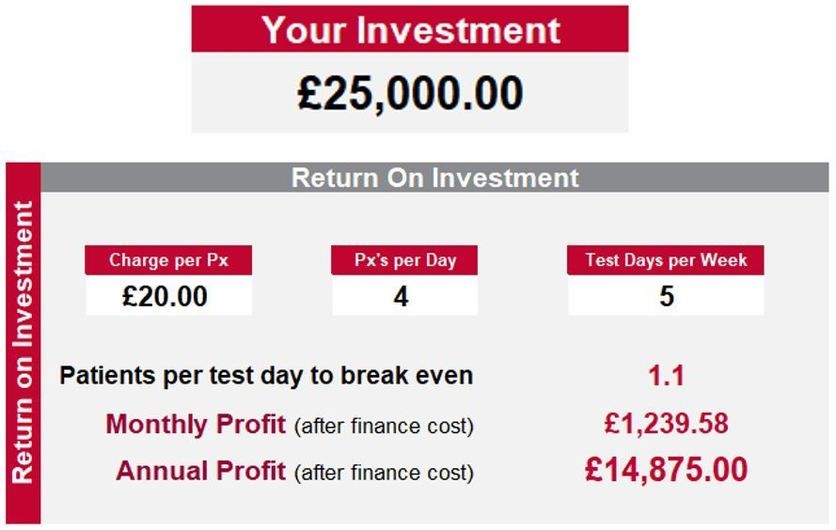

Financing the acquisition over 3-7 years will allow you to make a return from day one.

A finance lease will also ensure VAT is spread for those who can reclaim VAT under de minimis.

Additionally, the annual investment allowance (AIA) allows you to maximize your benefits and receive tax breaks whilst investing in any capital equipment…

In terms of income generation, the charge per patient and throughput are driving factors.

Funding your new OCT, will help ensure it pays its way and you can choose different ways to increase your revenues:

- Charge a separate OCT fee

- Increase current test fee to include OCT

- Monthly payment plan (Eye plan)

OCT purchases often include Marketing support and Educational events & workshops to help you get the most from your device.

Here at Performance Finance, we also work closely with all major optical suppliers making the process easy, streamlined, and enjoyable.

Performance Finance is the UK’s leading optical finance provider, established in 2005, we have arranged over £500m of finance for our clients.

Our clients also enjoy personal service from our team of friendly Area Managers who are highly experienced and have a detailed commercial understanding of optical practices. We understand tax, VAT, and optical equipment.

Speak to one of our expert advisors on: 01536 52 96 96 or contact optical@perfin.co.uk